If you are an owner of commercial premises, there is a tonne of information that you need to know to secure the perfect tenant and maximise the return on your investment (ROI).

The problem is, your time is also a premium asset of which you only have a finite amount. Most property investors do not have the time to spend doing a tonne of research to find all the answers and pertinent information. If this describes you, then you have come to the right place!

Commercial leases can be a complicated topic. There are a myriad of laws and regulations that govern what you can and cannot do, especially if the premises is primarily used for retail purposes. In this article, we are going to explain everything you need to know. After completing reading through this article, you will be ready to lease your commercial property with confidence.

What Is A Commercial Property Lease Agreement?

A “lease” is a contract where one party (the lessor or landlord) grants another party (the lessee or the tenant) the right to occupy and use a certain piece of land, in exchange for money or “rent.” A commercial lease is one where the premises upon the land are used for commercial purposes.

The simple act of accepting money from someone in exchange for occupying the premises on the land is said to be a verbal lease, it is legal, and it is binding.

However, there is a problem with this type of handshake arrangement – nobody knows the specifics. There are many details left to chance.

For instance:

- how often should the rent be paid?

- How long can the tenant keep possession of the premises?

- Is the tenant entitled to use other parts of the property (such as areas used by other tenants)?

- Who is responsible for the maintenance of the premises?

- In what way are you allowed to use the premises, or in other words, what is the “permitted use”?

As you can see, many questions can arise. A verbal lease agreement leaves most of them unanswered which can be dangerous for both you and the tenant. That is precisely why experts nearly always recommend using a written commercial lease agreement.

The commercial lease document is the written expression the agreement between the parties. Its purpose is to clarify the points of agreement and to protect the interests of both parties. With a commercial lease document, you are also able to minimize misunderstandings.

Residential leases are generally designed to be more of a one-size-fits-all agreement. Commercial contracts on the other hand often have a lot more flexibility with more room for negotiation. These negotiable areas include the length of the lease, options to renew, permission to assign a lease or sublet, fit-outs, the rent payable and timed increases.

Ten Ways to Negotiate a BETTER Commercial Lease Agreements

Now, depending upon whether you are a landlord or a tenant, you are going to have different objectives when negotiating the lease. As with any negotiation, it is crucial to understand the perspective of the other party.

If you are the owner, your primary considerations are likely to be finding a long-term tenant who pays the rent on time and looks after your premises. However, if you are a tenant, you’re likely to be more concerned with securing the premises for the long term and paying the least amount of rent possible.

There are several ways to make sure you strike the right balance when it comes to negotiating your commercial leases. If you find yourself hammering out a deal for the first time, being familiar with these ten essential lease tips will help you arrive at a better deal.

#1 – Consider a Rent Free/Reduced Rent Period

If the premises are in a high demand area, the landlord will have little reason to bend to the potential tenant’s wishes. However, savvy landlords who are trying to lock in a high-quality tenant will often entice the prospective tenant with various incentives. Sometimes the incentives are tied to more extended lease periods, which are designed to afford the landlord the security of rental return.

Even if your potential tenant is not offered incentives straight up, you can always use this tactic to get the right tenant across the line.

Consider offering a rent-free period (say three months’ rent free) or go for a percentage off the annual rent for the first year (for example, 10% reduced rent for the first year). Start-up businesses are likely to appreciate the relief until they have established their business.

#2 – Work in A Fit-Out

There is a lot of work required to customise the premises of a rental property for the specific requirements of your tenant’s business.

Typically, the tenant is the one who will be responsible for performing the fit-outs. It is essential to know who is going to be the one taking responsibility for the change in these instances.

You as the landlord may agree to undertake certain fit-out works to the premises (painting, electrical, lighting, installation, etc.). The key here is to make sure you record the works in the lease and if it’s a retail lease also in the landlord’s disclosure statement. That way everybody is on the same page, and there are no surprises!

Australian’s retail leasing legislation generally says that a tenant does not need to start paying rent until the landlord has substantially complied with its fit-out obligations (if any), which gives the tenant a lot of leverage in the negotiation process.

If possible, limiting your obligations in relation to the fit out during the negotiations will lessen the need to comply and ensure your income stream flows sooner rather than later.

#3 – Pay Attention to “Permitted Use” and council Zoning

When you are negotiating the commercial lease, ask yourself – how does the tenant intend to use the premises? Most lease documents have a ‘permitted use’ clause that restricts the tenants’ use of the premises to the permitted use only.

Doing proper homework beforehand can also save you a lot of trouble and headaches when it comes to council zoning. Ultimately it is the tenant’s responsibility to ensure they have the local council approval for the permitted use.

As the landlord, it will save your time if you let your potential tenant know that they need to seek council approval for the permitted use. Have them speak to the town planner, check the council website, as well as planning documents.

The tenants will also need to get up-front approval from you for the permitted use.

Generally, a tenant will try to negotiate as broad a scope of the permitted use as possible. For example, instead of a very restricted definition of ‘manufacture of light bulbs,’ they will go for something like: ‘manufacture of goods’, or ‘any use allowed by law.’

For the tenant, a widely defined permitted use clause has many benefits including:

- Enabling them to expand their business activities

- Making it easier to assign or sublet the premises in the future

- Ensuring they do not run afoul of you, the landlord

As the landlord, you need to keep in mind a long-term vision for your property. Will the changes proposed by your tenant affect your ability to lease the property in the future?

It’s worth remembering that the tenant must get the landlords consent if she / he wishes to change or expand the permitted use that is specific or limited. Which of course gives you a degree of control over what business activities the tenant can conduct from the premises and how they can use the building.

A tenant should seek consent by submitting a request in writing to the landlord. If the landlord agrees, document the change to the permitted use by way of a standard Amendment to Lease Agreement (sometimes referred to as a Variation of Lease).

If the lease is ever assigned, any new tenants will be bound to the permitted use, unless the landlord consents to change it.

Something to keep in mind – if the tenant ever decides to assign or sublet the commercial property, the assignee or sub-tenant also needs to act within the scope of the permitted use specified in the lease. Unless the landlord agrees otherwise, it is essential to make sure this is understood up front.

#4 – Consider the Length of the Lease

Depending on the kind of tenant you are considering leasing to, remember that you have control over how long of a lease you agree to. Short term leases do provide you with a lot of flexibility, allow you to keep an eye out for better options, and make you nimbler should the market change. The lease can also include options for your tenant regarding the ability to extend the lease after the initial lease term expires.

Short term leases are not usually as attractive to landlords for apparent reasons. Sometimes getting a new tenant can be a long, arduous, and expensive process.

Long-term leases seem to be the obvious solution, right? The answer is mostly yes, but it depends on your circumstances and your tenant. While landlords generally have some more latitude regarding early termination of a lease, lease agreements locking you into a long-term relationship with a bad tenant can be a headache.

An alternative might be a lease with options for extension. For example – a lease with an initial term of one year, with five one-year options after the initial one-year term expires, or an initial three-year term with three options to renew.

#5 – Double Check the Cost of the Lease

One of the most important things that tenants take into consideration when considering a commercial lease agreement is the price. But not just the apparent rental cost, but all the other expenses that might be hiding along the way.

As the landlord, calculating rent can be accomplished in several ways. Sometimes you can charge rent calculated as an amount per square metre. If this is the case, you should double check the area of the rented premises and the calculations to ensure you are charging the correct amount.

Smart prospective tenants will understand that the cost of the lease is not just the starting base rental amount. There are a ton of little expenses that can add up to more than the tenant would like to pay. You do not want to scare off a tenant by surprising them with a bunch of fine print expenses such as:

- Outgoings*

- Maintenance

- Local government rates and charges

- Taxes

- Security Fees

- Cleaning, water charges

- Sewerage and drainage rates

- Insurance

- Management fees

- Legal fees

- Electricity

- Garbage removal

- Air conditioning

- Common area maintenance fees

- And more

*Some landlords choose not to charge extra for outgoings, but rather incorporate all associated costs and charges into the base rent amount.

Most tenants won’t understand the substantial costs that go hand in hand with owning a commercial property. The question to ask here is – will the rent include all of your property-holding costs, or will the tenant have to take care of and pay your outgoings (which may consist of land tax, council rates, and water connection rates)?

It is likely that your tenant or their legal advisor will want a concrete answer to this question before they sign a lease agreement, which is the reason any outgoings must be included in the Landlords Disclosure Statement (included in our Retail Lease Kit).

Remember, under Retail leasing legislation, if the outgoings are not declared in the landlords disclosure statement the tenant does not have to pay them even if you have included them in the lease.

The difference between a gross rental deal or a net rental deal can mean a lot of money. With this knowledge, you can figure out what you will earn as a net total, and then you will be able to forecast your investment return you over the long term.

#6 – Check the Stated Options Regarding Lease Renewal

Again, looking at things from the tenant’s point of view, it can be devastating to spend considerable time and money cultivating a business presence at the location of your rented premises, only to find out the lease has ended, and the landlord requires you to move out. Some states (but not all) have minimum 5 year terms in retail leases to protect the tenant from this situation.

As the landlord, providing your tenants with security of tenure will prevent them from having to worry about finding themselves on the street before having time to recoup the money they have outlaid to fit-out the premises and establish their business.

To do this, you will want to make sure that the lease agreement provides options to renew the lease once the initial term has expired, should they choose to stay on.

For example, you might have a three-year initial lease term with two options to renew, (3x3x3) each for an additional three-year period. In this case, your tenant would effectively have the right to lease the premises for 9 years, should they wish to do so.

Each situation is different and what suits one business owner may not suit another – so think about what is right for you.

#7 – Take Rent Reviews into Consideration

If you think about it from the tenant’s point of view, having your rent bumped up during the term of your lease can cause a lot of strain on their budget. On the other hand the landlords investment return will be going backwards if you are not at least keeping pace with inflation. If they were planning on paying a certain amount per month, suddenly having their rent increase can be a very unpleasant surprise and may  lead to you losing a good tenant.

lead to you losing a good tenant.

There are several common rent review methods, including:

- Market rent

- Movements in CPI

- A fixed percentage (e.g., 3%)

- A fixed amount (e.g., $100)

The frequency of rent increases will vary so look closely at how you want to handle this. You might stipulate that the rent will be reviewed every six months, annually, every three years or something else.

Typically, though, rent is going to increase on an annual basis. If this is the case, and you and your tenant sign a long-term lease (3 years, five years), the tenant ought to understand the Rent Review clause.

Market rent review will usually take place after the initial term and but before the tenant exercises their option to renew.

While a 3% increase every three years may be acceptable to the tenant, it may be excessive if it applies every six months. The last thing you want is to lose a good tenant because they failed to understand the fine print. Being up front and honest will go a long way in creating a good relationship that can continue for years to come.

If it is helpful to the tenant, it may be worthwhile to calculate the cost of the rent in real dollar values over the term of the lease. By doing so, you will be able to provide them with an accurate picture of what the contract will cost in Year 1, Year 2, Year 3 and so on.

The cost of the lease in the third year might be vastly different to the price in the first – mainly if you have provided the tenant with initial lease incentives. Realize that the tenant will most likely try to negotiate if they feel the rent increase provisions are out of their budget or excessive.

#8 – Who Will Maintain the Premises?

Does the lease require you to undertake or contribute to maintaining the premises?

Maintenance tasks can include duties such as painting every five years, garden maintenance, or regular updates to the fit-out, etc.

Make sure the requirements in this regard are fair and within reason – not to mention within your tenant’s budget!

#9 – Talk Through Improvements to the Premises

If you have a tenant moving into your building or property, remember they must get your consent to make alterations. Most lease agreements stipulate that the landlord cannot unreasonably withhold their consent to any requested improvements that the tenant may need to make to the premises.

However at the end of the lease, the tenant must return the premises in substantially the same condition as they were at the beginning of the initial term.

As they say, knowledge is power, so going into your lease negotiations primed with the facts will allow you to hash out a deal that will best suit your circumstances.

#10 – Having the Ability to Assign or Sublet

As the landlord, you have rights and obligations that you need to keep in mind.

In the so-called ‘sharing economy,’ some retail stores are seeking to economise on space and real-estate costs. For example, the retail premises may be too large for their business needs or the lessee is trying an alternative to terminating the lease.

However, there are strict guidelines on the method of seeking consent and whether you as the landlord are permitted to withhold your consent. A tenant can go one of two routes – they can either assign their lease over or they can sublet.

Assigning a Lease

A tenant may assign their lease over retail premises by transferring existing rights and obligations under the agreement to a third party. The original tenant essentially ‘steps out’ of obligations under the first lease and the new tenant ‘steps in,’ becoming bound by the terms of the original lease.

Subletting

Alternatively, when a lessee subleases the premises, they essentially form another lease agreement with a third party. While the original lease and tenant obligations remain, sub-tenant receives rights to exclusive possession over all or part of the premises. Therefore, while the original agreement still exists, a new contract is formed between the head tenant and the sub-tenant. The head tenant is also liable to the landlord for damages or lease violations by the sub-tenant.

Landlord Consent

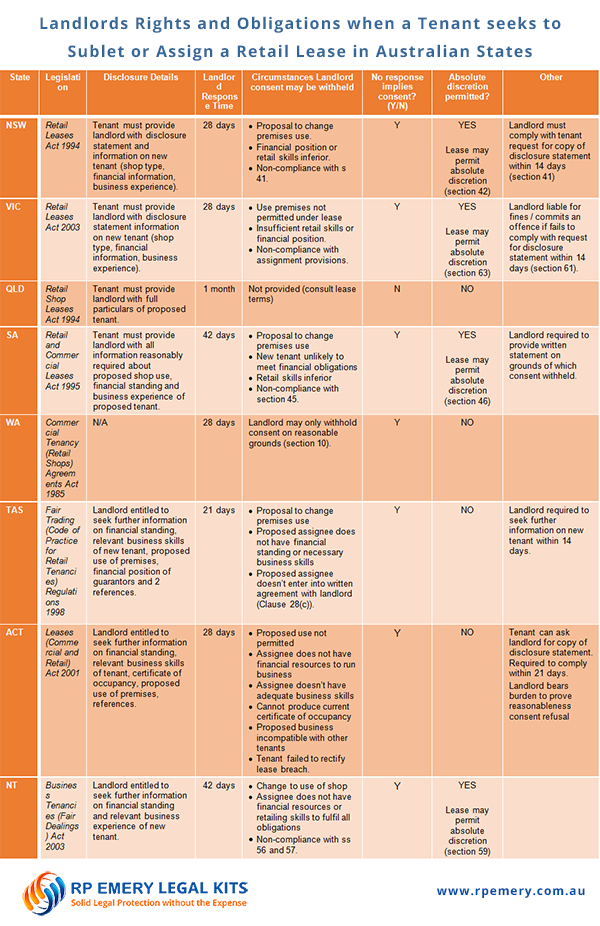

Legislation strictly limits the circumstances whereby a landlord may refuse consent to assign the lease or sublet retail premises. While written permission must be sought in all jurisdictions; there are differences between States with regards to:

- Disclosure of proposed tenant’s details

- Landlord response time

- Circumstances where consent may be withheld

- Whether a failure to respond automatically infers consent

In New South Wales, a landlord cannot reasonably refuse a request to sublet or assign a lease, unless the use of the premises will change, or the proposed tenant has inferior retail skills and financial resources.

Additionally, NSW, VIC, SA, and NT legislation explicitly enable the landlord to refuse consent in their ‘absolute discretion’ if the lease terms permit.

See the table below for more details by State – click image to enlarge

Remember:

If your tenant is seeking consent to sublet or assign their retail lease, here are some keys things to keep in mind:

- Your tenant must comply with the legislation (including seeking permission in writing)

- Failure to respond may imply landlord consent

- The landlord must respond within a specific time frame

- Check the terms of the lease whether ‘absolute discretion’ is permitted

- The landlord generally cannot withhold consent unreasonably

It is always a good idea to consult the relevant legislation in your jurisdiction as to whether you can withhold consent and under what circumstances. If you are unsure about consenting to sublet or assigning a lease over your retail premises, do the smart thing and consult independent legal advice. You will feel safer if you do.

Expenses you can claim as Tax Deductions for your Commercial Property – Click the image for larger image

Things to Know About Self-Managed Superannuation Funds

Sometimes, leasing property is not a good fit for your tenant’s business needs. A popular strategy among business owners is to purchase (or transfer) their business premises into a Self-Managed Superannuation Fund (SMSF). In these situations, the business entity (or individual) leases the property as the tenant.

Even if your SMSF does not have the full purchase amount, SMSFs can borrow money for this purpose, if done correctly and by the Superannuation Industry Supervision Act, 1993 (the SIS Act).

An SMSF may borrow funds from a related party. Alternatively, a financial institution may provide the funding, many of which now offer packages tailored explicitly to SMSF lending.

Any loan arrangement between a business owner (or other related entity) and their super fund must be at arm’s length and adequately documented to ensure compliance with the SIS Act. The loan must be in writing, on commercial terms and payments under the loan agreement must be met, to stand up to the scrutiny of auditors and regulators.

Purchasing or transferring commercial premises to an SMSF is not a standard process and is a heavily regulated area of the law, with the purpose of preserving super funds for retirement.

Always Do Your Homework

A commercial lease agreement is a big commitment that can also have big returns. It can mean an investment of years and deal with one tenant on a regular basis. That is why your first move must be doing your homework – diligently, and thoroughly. This will prepare you to be able to negotiate with all the facts before you.

Shop around, check your local markets and surrounding markets. Talk to commercial agents in your area to get an idea of what rents are going for in your area. Take your time and remember that each property is unique and has advantages and disadvantages to consider.

Depending on the business that your tenant has, what they are selling, and their target market, their dream commercial business property will differ. So, you must ask yourself – what is the most critical thing for this tenant about potential commercial property? Is it good parking? Great frontage? Easy access?

Whatever is the most critical part for them, see what things you could potentially sacrifice to get them to their number one goal. The last thing you want is for them to think yours is the “perfect property” only to realize that it is missing a critical element that is going to mess up their business.

Doing proper homework beforehand can also save you a lot of trouble and headaches when it comes to council zoning. Zones determine what kinds of business can operate in what areas.

For your potential tenant, filling out the proper applications, having the appropriate approval, and involving a town planner are all things that can take time and money. Knowing beforehand could save everyone involved a lot of pain.

If you are a landlord, it will save time if you let your potential tenant know that they need to speak to the town planner, check the council website, as well as planning documents. The responsibility for having this information ultimately falls on the shoulders of the tenant, so they should not be counting on you or real estate agent to do this part for them. As the landlord, you need to make sure your potential tenant has accomplished these tasks before moving forward.

As we have already discussed, one of the most critical parts of doing your homework involves counting the cost. What is your projected cash flow for X number of years that you plan on being in this lease?

Summary

There are a lot of things to keep in mind when it comes to leasing out your commercial property. Sometimes it can be a bit overwhelming. Being a landlord can be a lucrative and exciting thing, but it can also be stressful when you realize how many details are required to do it right.

And that’s precisely what this article was all about – providing you with the information you need to make decisions regarding leasing your commercial business property. Now it’s time to get busy and make it happen!